7 Brownfield vs. Greenfield Automated Solutions Development Considerations

Deloitte Center for Financial Services reports that the logistics real estate market is softening in their “2024 commercial real estate outlook: Finding terra firma”| Deloitte Insights.1 Rising warehouse rental rates, economic conditions, the cost of capital, and dynamic consumer trends are causing leaders to take a different view of their distribution network growth and expansion strategies when deciding between new greenfield sites and improvements to existing brownfield facilities.

With the cost of labor remaining as the driving factor, distribution and fulfillment operations are retrenching to achieve gains based on best practices, Lean process improvements, selective retrofits, and automation implementations with solid shorter-term ROI. The cost of a new facility, regardless of current trends, new construction, or lease, is always a large part of a greenfield project and the financial burden on the company.

So, how do you decide on the right solutions for your operation? Read on...

Approach

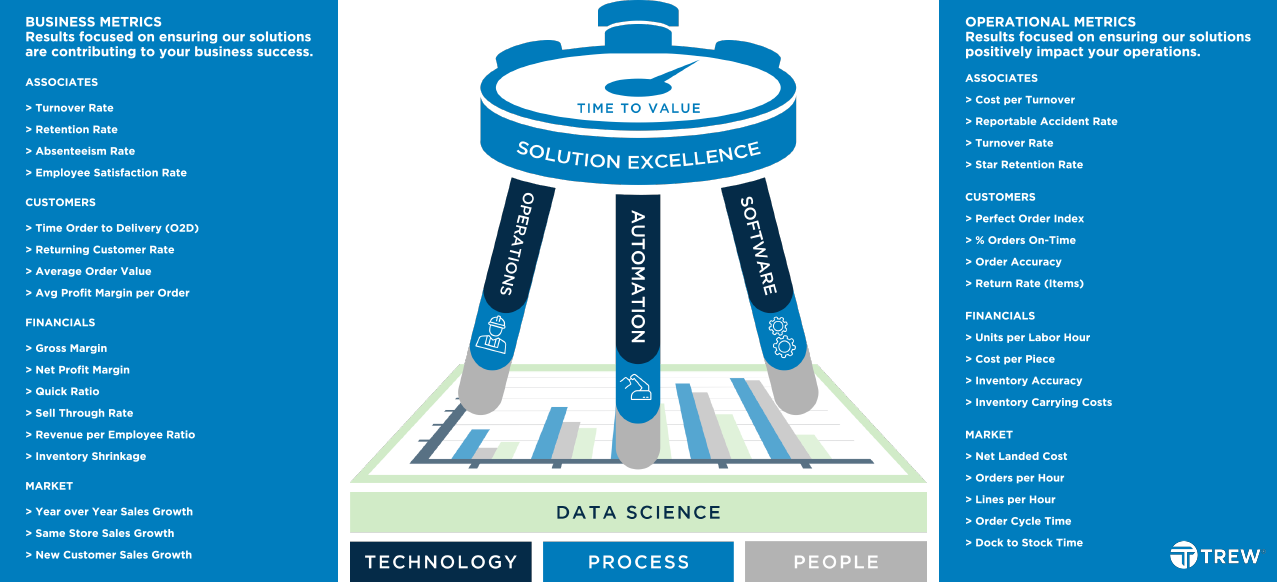

The approach to developing solutions for both greenfield and brownfield projects is basically the same. The goal: develop a solution that has the right balance of technology, operational fit, ROI, and “time to value”. This solution development process typically has the following steps.

- Identify the business goals of the project, how those goals relate to operational objectives, as well as the operational behaviors, material handling automation, and software and data science that ties them together.

- Define the operational requirements so that key process steps are included and prioritized during the analysis and solution development steps.

- Use data science and operational expertise to leverage important and often hidden bits of information and trends that build the basis of insights and recommendations for solution design and planning.

- Assess technologies against the data science results to determine the fit and application of technology to best drive operational performance and business goals.

- Apply best practice ergonomics, and performance metrics to people spaces, work processes, and work management.

- Select best-in-class automation that provides the maximum ROI.

- Pull the solution together with the WES software that optimizes the throughput and performance.

- Build the staffing model and justification case.

The process is constantly focused on addressing the factors unique to your business, and delivering a solution tailored for your success.

Solutions Development Considerations and Approach

Where the solution development process for the two, greenfield vs. brownfield, diverge is within a few specific steps to identify current state. A greenfield design is fundamentally a “clean sheet of paper” with boundaries determined primarily by operational sense and justification. A brownfield, however, can get far more complex with limitations and parameters set by existing facility infrastructure, mechanization, and software functionality and interfaces.

ROI and Time to Value

Executives use various tools and methods to compare different options and choose the ones that offer the highest returns for choices like investing in products, services, operations, synergies, and allocation of capital across their organization.

Speed in the ecommerce, retail and warehouse and fulfillment operations to adapt to market and consumer trends is foundational to the success of an organization and must be part of the calculus of investing in future operations. In addition to the traditional metrics, the solutions development process should evaluate the Time to Value benefits of investing in existing vs. new facilities and operations.

| Often Used Financial Metrics |

|

Return on investment (ROI) - Measure of how much profit or value a project or activity generates compared to its cost. ROI = (Benefits - Costs) / Costs

|

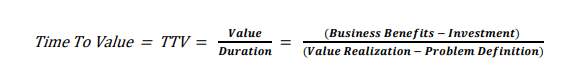

Time to Value (TTV) measures how quickly an automation project delivers value to the organization. TTV is calculated by dividing the total cost of the project by the annualized benefits the solution delivers. It shows the tradeoff of the time to operational beneficial use to the operational value derived. A lower TTV means a faster return on investment and a higher impact on the business outcomes.

|

Building the case for TTV requires the contributors to identify the cost and time required to achieve the desired outcome needs to be compared between greenfield and brownfield investments. Things like lost productivity during implementation, duration of pre-startup, throughput and productivity progressions, downtime for cut-ins, extra handling costs during implementation phase, training time and costs, etc.

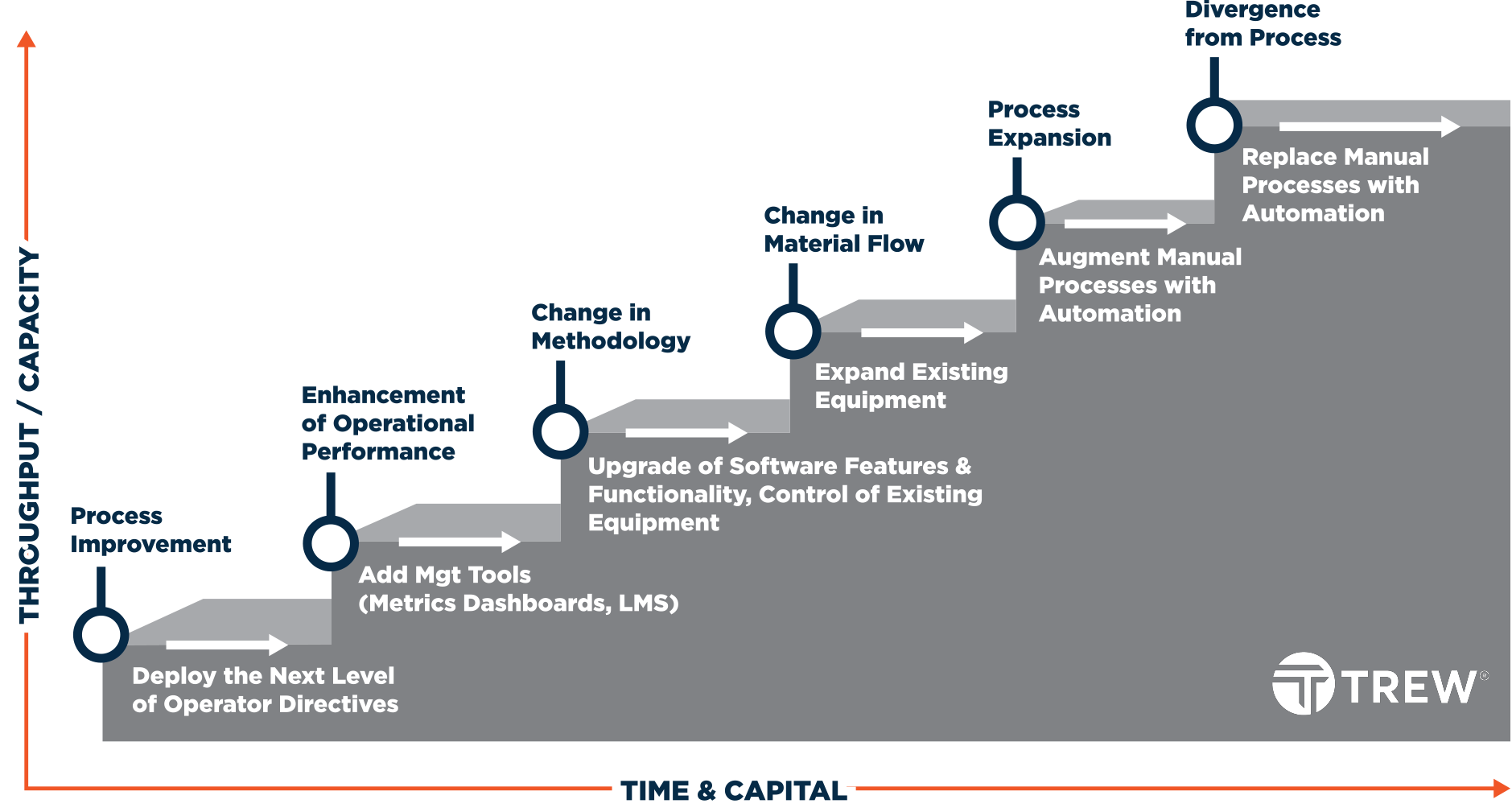

Leveling Up

As displayed in the graphic below, when developing brownfield solutions there are six levels of improvement based on targeted throughput, capacity, capital expense, project go-live, and return on investment. Each level (blue text) indicates a rise in performance based on a type of “what if” change to occur, while the orange text identifies the “what could be” potential for solutions.

Six Levels of Warehouse Performance Improvement

In the case of brownfield projects, there are four things that need to occur before the solution development can start.

- A material flow assessment to determine future bottlenecks and capacity limitations.

- A capacity analysis to discover the current utilization of storage, and how much more is needed.

- A throughput analysis to identify the “headroom” of existing automation, the configuration limitations, and how each subsystem may need to be expanded, augmented or even replaced in order to achieve project goals.

- A communication flow or interface specification to identify the needs for future controls and software applications.

Conclusions and 7 Considerations

Today’s supply chain environment is complex and full of disruptions escalated by growing ecommerce demand and rising costs, increasing throughput and capacity can be achieved through brownfield investment in automation with real results, increased operational flexibility, better time-to-value, and typically less capital.

Here are seven questions you can ask yourself to determine if your operation could gain significant improvement with a brownfield solution.

- Are the business goals for volume and SKU count growing beyond current capacity?

- Does the current system have throttles that limit throughput, process steps that create extra touches, and additional labor that is inflating bottom line cost per unit?

- Is there space available for expansion or repurpose?

- Is the current software functionality up to date?

- How much is the age or performance of existing equipment and mechanization hindering the operation?

- Is your operation losing staff to newer and/or more automated competitors?

- How do your productivity rates benchmark against competitors and industry best-in-class?

References:

- Deloitte. (2023). 2024 commercial real estate outlook: Finding terra firma | Deloitte Center for Financial Services. https://www2.deloitte.com/us/en/insights/industry/financial-services/commercial-real-estate-outlook.html

- JLL. (2023, August 02). United States Industrial Outlook | Q2 2023. Research. https://www.us.jll.com/en/trends-and-insights/research/industrial-market-statistics-trends/

PDF Download: Trew Talk - 7 Brownfield vs. Greenfield Automated Solutions Development Considerations